Avoiding Probate

The most common reason for estate planning it to avoid probate. We’ve all heard nightmarish stories from family, friends, and the media about assets getting held up and unfairly distributed by probate court. Your assets are yours no matter how small or large and you best know what you want done with them. An estate plan will keep your estate from being handled in probate!

Reducing Estate Taxes

The most basic planning can help married couples reduce and maybe even eliminate estate taxes altogether by setting up AB Trusts or ABC Trusts as part of their wills or revocable living trusts. There are some advanced estate planning techniques that will help estate or inheritance tax bills be less burdensome after you pass.

Avoiding Confusion After You Pass

Many people have experienced a situation when a loved one failed to make a estate plan before they passed and saw the wreckage it caused. Passing without an estate plan can cause significant stress on the family and become and unneeded waste of time and money.

Protecting Beneficiaries

Many estate plans are made to protect minor beneficiaries or adult beneficiaries from making bad decisions because they are young or because they are being influenced by outside forces from creditor problems, divorcing spouses, and worse. Estate planning techniques can help you protect your loved ones even after you’ve passed. You can designate a guardian and a trustee for your minor beneficiaries and you can take precautions to help an adult beneficiary from making bad decisions with their inheritance.

Protecting Assets from Unforeseen Creditors

Asset protection planning is a combination of a sound financial plan and a well thought out estate plan that can protect your assets during your lifetime and your beneficiaries after your passing. Without asset protection planning, your life’s work can be erased with one unfortunate lawsuit or series of mishaps.

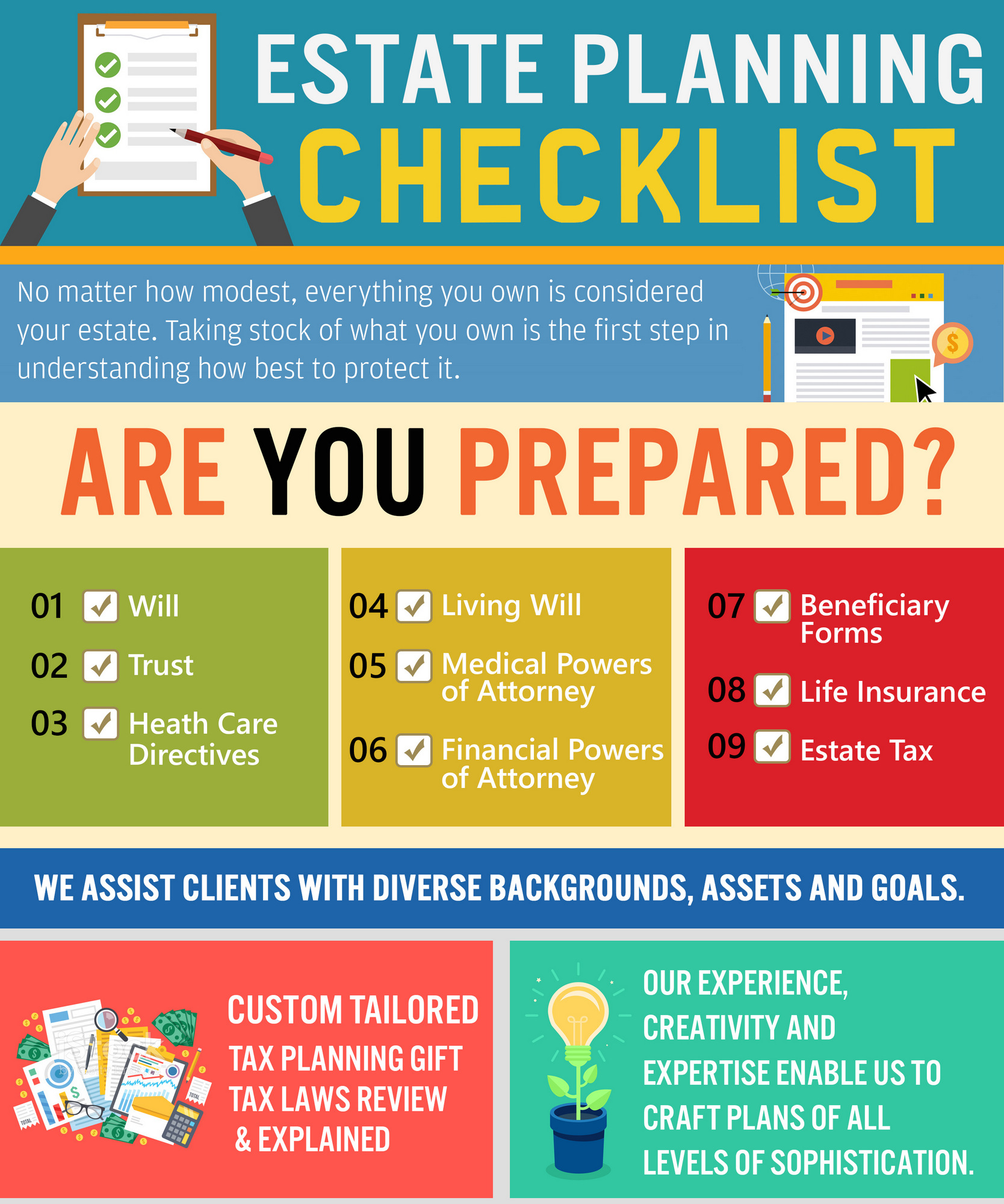

We Help Clients With Estate Planning

If you were to pass away without a will, you’d be leaving you family in a bad position. It only takes an Estate Planning Consultation to figure out what you need to do to protect your family. The people you love most will thank you for thinking of them! You’re never too young to discuss estate planning.

> Learn More

There are other reasons for estate planning but these alone can show why almost everyone should have their estate planned before they pass.

Contact Us (859-371-0730) for a Consultation Today

—

About Helmer Somers Law

About Helmer Somers Law

Helmer Somers Law helps individuals and businesses navigate the complex system of rules that accompany all legal situations. We are licensed to practice in both Kentucky and Ohio and offers flexible, affordable payment terms for our services. We welcome the opportunity to earn your trust and become your lawyer for life! It’s a fact of life in the modern world. There comes a time for virtually every adult American when the services of a competent, dedicated lawyer are required. Circumstances such as divorce, bankruptcy, estate planning or an income tax audit demand that your rights be protected, and your long-term interests advocated for with diligence and perseverance. When you call Helmer & Somers Law, you can rest assured that they will be.

About Helmer Somers Law

About Helmer Somers Law